Moving from “Cool Experiment” to “Lean AI Empire”

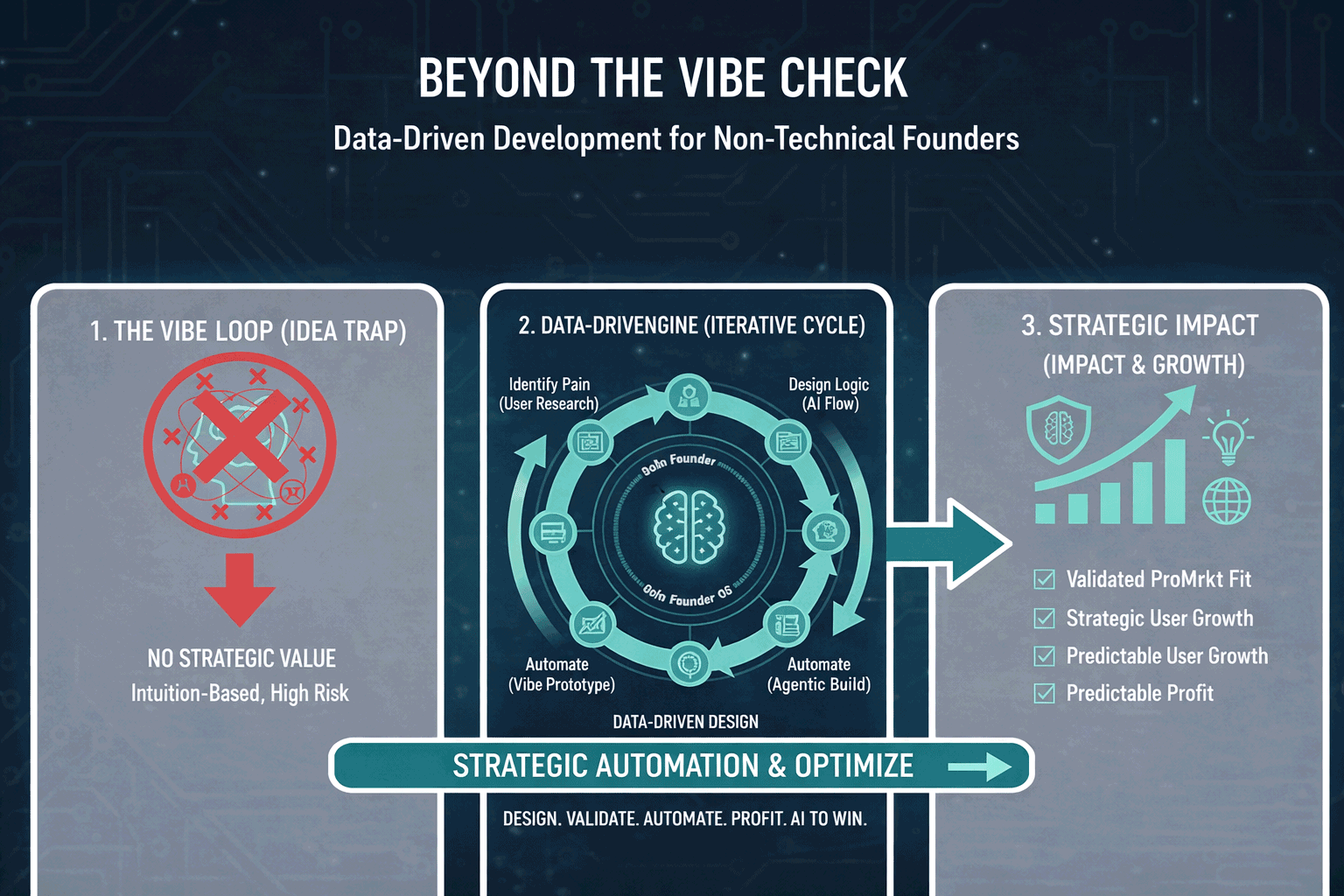

You’ve felt it. That flow state where the distance between a thought and a working feature is measured in seconds, not sprints. Using tools like Lovable, Bolt.new, Cursor, or Replit Agent, you’ve successfully prompted your way into a micro-SaaS that actually solves a problem. People are using it. They’re liking it.

You’ve moved from “I hope this works” to the terrifying realization that people are relying on your code.

Your pilots are converting. Your experiments are optimizing. The “Revenue Radar” you vibed into existence is signaling the ultimate validation: users are asking for “Pro” features. You find yourself at a pivotal junction, likely between your first 10 and 100 paid users.

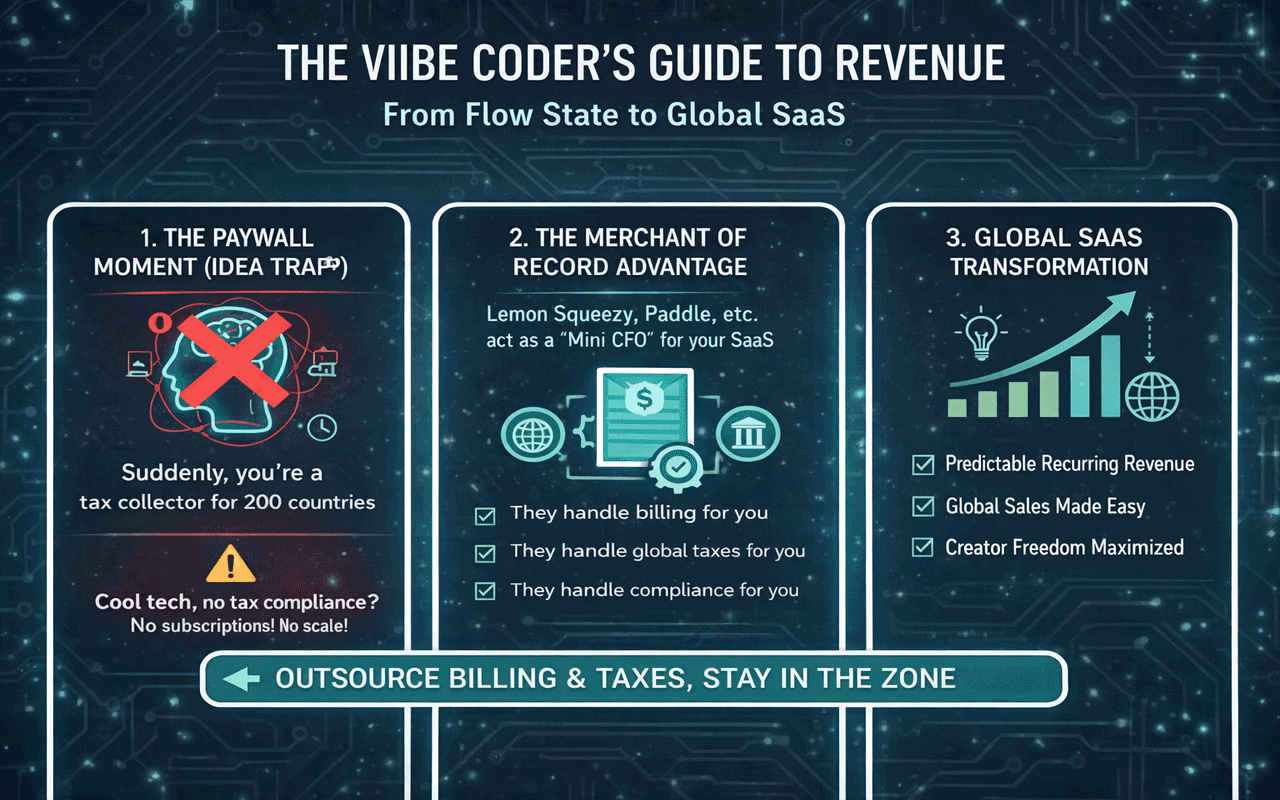

This is the moment where the vibes usually go to die — the transition from Builder to Global Merchant.

Suddenly, you aren’t just a creator. You are a global merchant. A tax collector for 200+ jurisdictions. A fraud investigator. A compliance officer navigating PSD2, SCA (Strong Customer Authentication), and global VAT.

In 2026, the goal for a lean founder is not to “build billing.” It’s to outsource the headache.

This post is about graduating. We’re moving from “cool experiment” to Lean AI Empire. To do that, we need a partner that acts like a Mini CFO — so you can stay in flow.

1. The 5-Layer Monetization Blueprint

In 2026, “production-ready” monetization doesn’t mean building a billing engine from scratch. It means shifting from one-off payments to a reproducible subscription pipeline with deep observability. To stay lean, your stack must handle the boring financial layers automatically.

Most founders underestimate the complexity of a global rollout. It isn't just about the credit card swipe; it's about the "Long Tail of Liability." If you sell to a user in Berlin, you owe the German government VAT. If you sell to a user in New York, you may owe Sales Tax based on economic nexus thresholds. Managing this manually is a full-time job.

| Layer | Production-Grade Standard | Why It Works for Solos |

|---|---|---|

| Gateway | Merchant of Record | Outsources 100% of tax liability across 200+ countries. |

| Compliance | Automatic Remittance | One monthly invoice. No EU VAT or US sales-tax panic. |

| Growth | Dunning & Recovery | Recovers failed payments automatically (+10–15% MRR). |

| Support | Managed Billing Support | They answer “Where’s my invoice?” emails — not you. |

| Analytics | ProfitWell / Metrics | Live MRR, churn, and LTV without spreadsheets. |

The Mathematics of Sustainability

To understand real business health, you must look past surface-level MRR. In the world of AI, revenue is not profit. Every time a user interacts with your "vibe-coded" features, you are incurring a cost in the form of GPU compute or API tokens.

Gross AI Margin (Mg):

Mg = (Revenue − Token Costs) / Revenue × 100

A healthy Lean AI business targets Mg ≥ 75%. If your margin is lower, you are likely over-using expensive frontier models (like Claude 4.5 Sonnet or GPT-5.x) for tasks that a "Mini" or "Flash" model could handle with 90% accuracy at 1/10th the cost.

Effective Payout Margin (Me):

Me = (Net Payout − (Server Costs + Token Costs)) / Gross Revenue × 100

A "Frankenstein Stack" (using multiple individual SaaS tools for tax, subscriptions, and payments) often leaks margin through hidden monthly fees and integration overhead. A Lean AI business should aim for Me ≥ 70%. If you are paying $200/month for billing software before you've hit $1,000 in revenue, your architecture is broken.

2. The Vendor Landscape: MoR vs. Processors

Choosing your payment partner is a choice between Full Control and Full Outsourcing. In the 2026 economy, the complexity of global digital sales has made the choice clearer for solo founders.

The Merchant of Record (MoR) Heavyweights

Platforms like Paddle and Lemon Squeezy act as the legal sellers of your software. Legally, they buy the service from you and sell it to the customer. This single distinction removes the need for you to ever register for VAT or Sales Tax in foreign countries.

- Lemon Squeezy: The "Set it and Forget it" partner. Best for design-conscious founders who want a high-gloss, overlay-style checkout that "just works." It is incredibly low-code.

- Paddle: The "Global Growth Shield." Better for B2B and scaling. Includes ProfitWell for free, which handles dunning (failed payment recovery) automatically. If a customer files a chargeback, Paddle's legal team fights it for you.

The Payment Processors (DIY)

Stripe is the engine of the internet. It gives you the "Lego bricks" to build anything. However, with Stripe, you are the merchant. You must use Stripe Tax (an extra fee) to calculate what you owe, and you are still legally responsible for sending that money to the appropriate governments. Use Stripe if you have complex, multi-layered usage billing that requires a custom-built engine.

3. Tactical Integration Speed-Run

Let’s wire these into your app using modern AI prompting techniques. We assume you are using a tool like Cursor, Lovable, or Bolt.new.

Phase 1: The UI Layer

Once you've created your product in your chosen dashboard and secured your Variant ID, use this prompt to build the frontend:

Phase 2: The Logic Layer (Webhooks)

You need your database to know when someone has paid. Don't write the webhook handler yourself—prompt for it:

4. Architecture & The Token Paradox

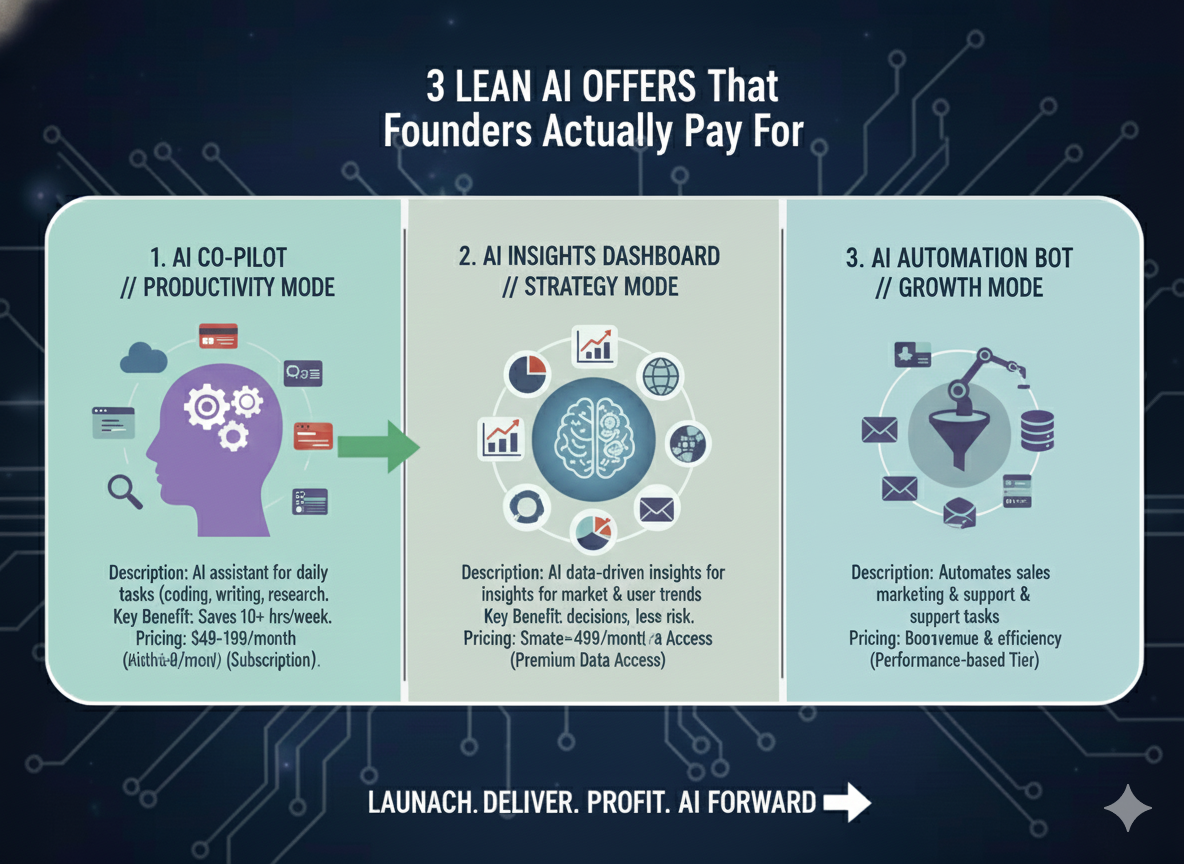

In 2026, the market is shifting toward Hybrid Pricing. This accounts for the Token Paradox: the phenomenon where token costs drop significantly, but total usage explodes as founders throw 100x more "horsepower" at complex problems.

If you charge a flat $20/month but a user runs 50,000 deep-reasoning prompts, your profit margin will collapse. You need a model that scales with usage.

Calculating the Value-Based Price (Pv)

Instead of guessing your rates, use this formula to find your floor:

Pv = (Hours Saved × Hourly Rate) × 0.20

If your AI saves a founder 10 hours a week at a $100/hr internal rate, your tool is worth $200/week ($800/mo). If you are charging $20/mo, you are leaving 97% of your value on the table. Move to a credit-based system or a tiered model where the highest tier is "Unlimited" but priced at a premium.

If your AI tool allows one user to do the work of five people, charging a flat 'per seat' price is a strategic mistake—you are capturing none of the value you've created.

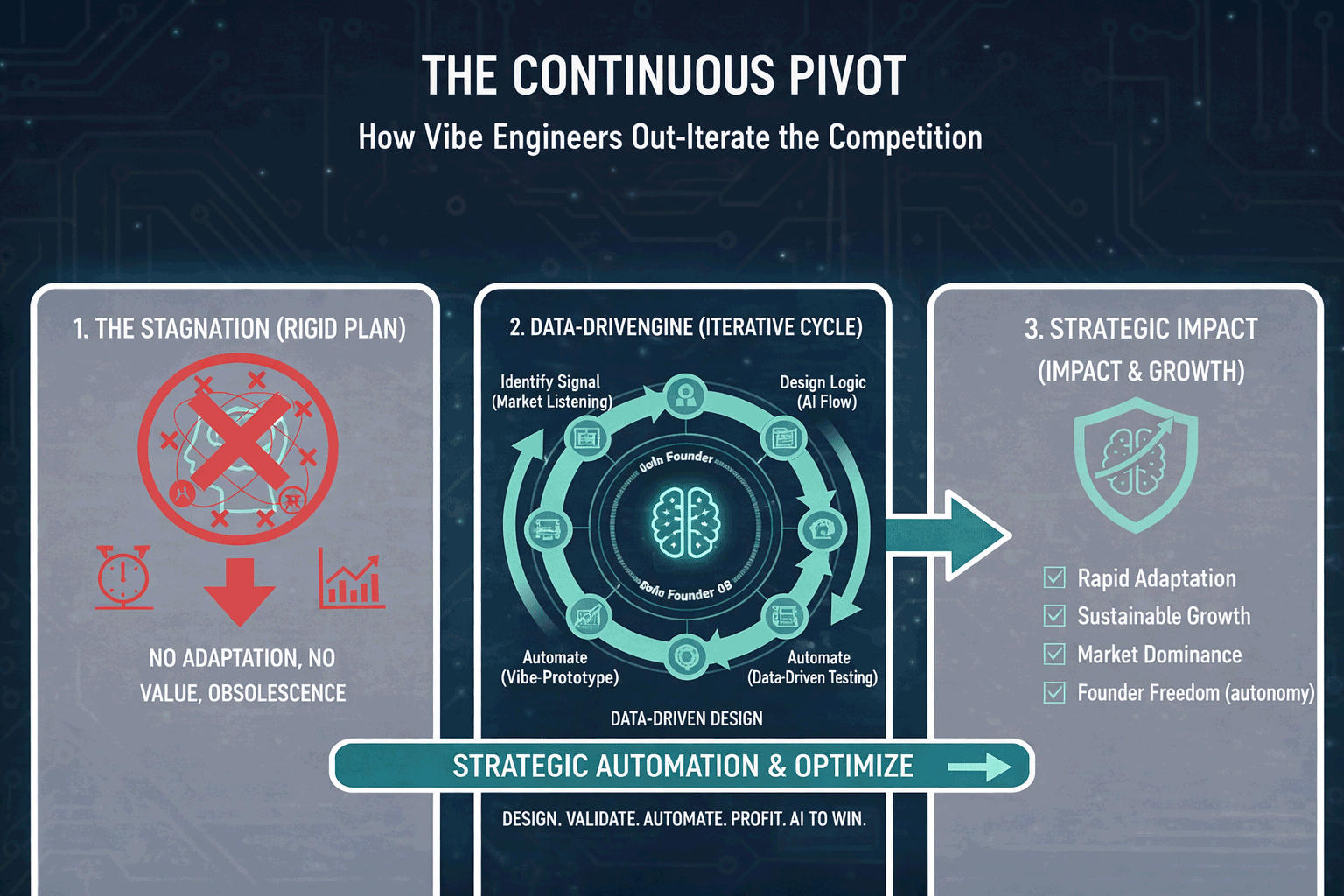

5. Case Study: Sarah’s Monetization Pivot

Sarah used Bolt.new to build an "AI Real Estate Description" tool. Within two weeks, she reached $2,000 MRR, but she was drowning in "Frankenstein Stack" complexity.

The Challenge: Sarah was using Stripe + TaxJar + Chargebee. She was paying $300/mo in subscriptions before a single transaction fee was even taken. When she hit 50 users in the EU, she realized she had no idea how to remit VAT in 27 different countries.

The Lean Pivot: Sarah executed a Zoom-In Pivot on her billing stack. She ripped out the Frankenstein Stack and integrated Paddle. By collapsing her billing into a single MoR, her Effective Margin jumped from 58% to 76% overnight.

The Result: She offloaded 100% of her billing support. When a user in France asked for a customized VAT invoice, Paddle’s automated system handled it. Sarah spent those saved hours building an "Agentic SDR" that doubled her leads.

6. The “Golden Rules” of Financial Security

- Never Store Card Data: This is the cardinal sin. If your code sees a credit card number, you are doing it wrong. Always use hosted fields or overlays provided by your partner.

- The “One-Source” Truth: Treat the Payment Platform as the source of truth. Your database is just a "cache" of the state. Periodically re-sync via webhooks to ensure your app stays in lock-step with reality.

- The Portal Hack: Don’t build a “Manage Subscription” page. It’s a waste of engineering time. All major platforms provide a “Customer Portal” link. Just add a button that says “Manage Billing” and redirect the user there.

- Usage Protection: If using usage-based billing, implement hard caps in your application code. Don't let a rogue AI agent run up a $5,000 token bill on a user who only paid $20.

Series Complete: The Lean Revenue Empire

The successful solopreneur of 2026 isn’t a genius at everything. You are the product visionary — not the tax accountant.

The tools are ready. The paywall is live. You've outsourced the taxes, the compliance, and the dunning. There is nothing left to do but grow.

Get back to the flow.

Disclaimer: This guide is not legal or financial advice. Tax laws, payment regulations (like GDPR and PSD2), and legal 'Nexus' thresholds are complex and vary significantly by jurisdiction. Consult a qualified tax professional, accountant, or legal counsel before making significant financial decisions.

No comments yet

Be the first to share your thoughts on this article!